FINANCIAL MARKET INSIGHT

VANN EQUITY MANAGEMENT

October 2024

HIGHLIGHTS

- Why the Next Two Weeks Are So Important for This Market

- Market Preview: Magnificent Seven Earnings and Important Economic Data

- Economic Cheat Sheet: Jobs and ISM Manufacturing PMI on Friday

- Sentiment: Still Not as Wildly Bullish as You Might Think

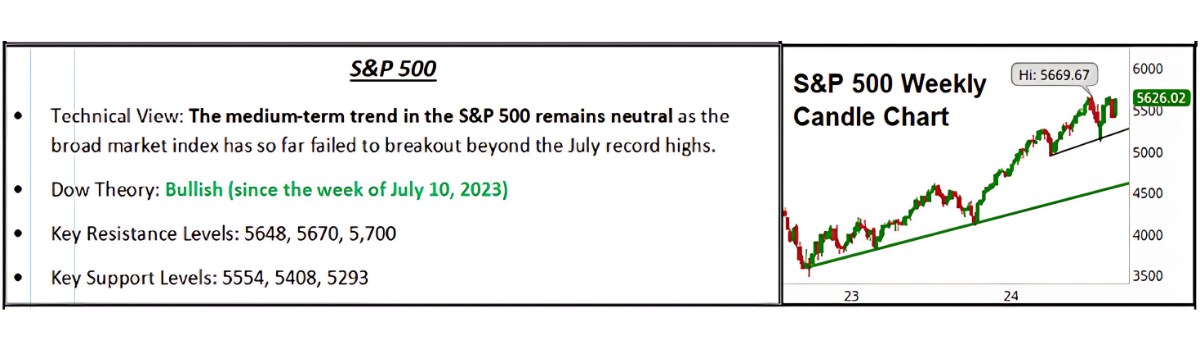

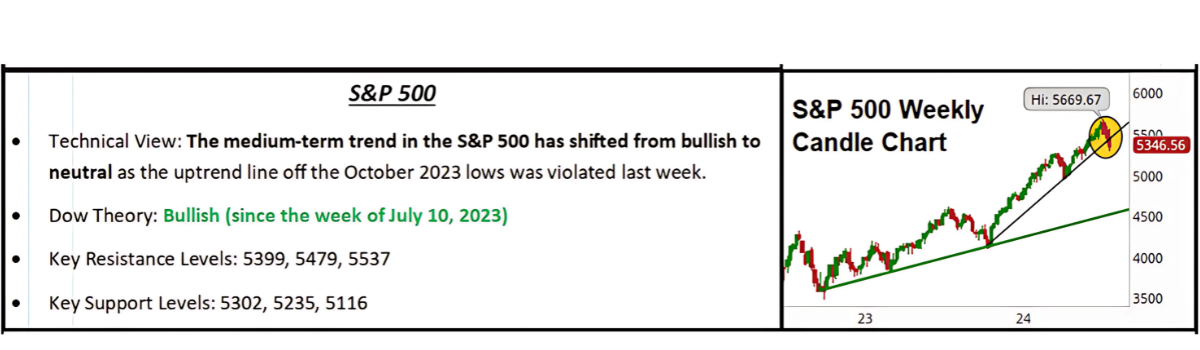

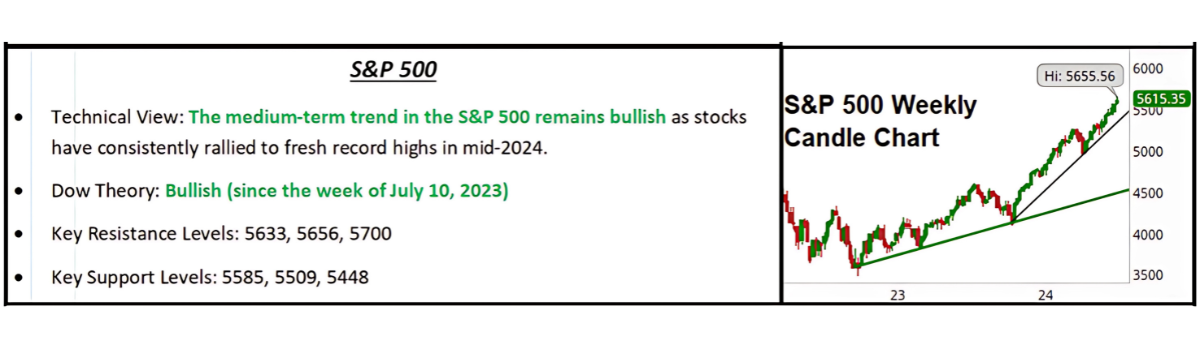

STOCKS

“Stocks declined modestly last week as Treasury yields rose to multi-month highs while earnings results were a bit more mixed, although the declines were modest especially compared to the recent rally.”

✓ What is Outperforming: Defensive sector, minimum volatility, and sectors linked to higher rates have relatively outperformed recently as markets have become more volatile.

✓ What is Underperforming: Tech/growth and high valuation stocks have lagged as yields have risen.

A Critical Two Weeks for the Rally

It is not an exaggeration to say that the next two weeks could likely determine if stocks hold (and potentially extend) the YTD gains, or if volatility re-emerges and we have a tumultuous end to what has been, so far, a good year in the markets.

We say that not to be hyperbolic, but instead because it is true, as each of the major supports of this rally will be tested over the next two weeks, and if the current positive market expectations are undermined, the S&P 500 could hit an air pocket of roughly a 5%-10% pullback (or possibly worse).

Let us Examine the Major Tests of Support in the Equity Market:

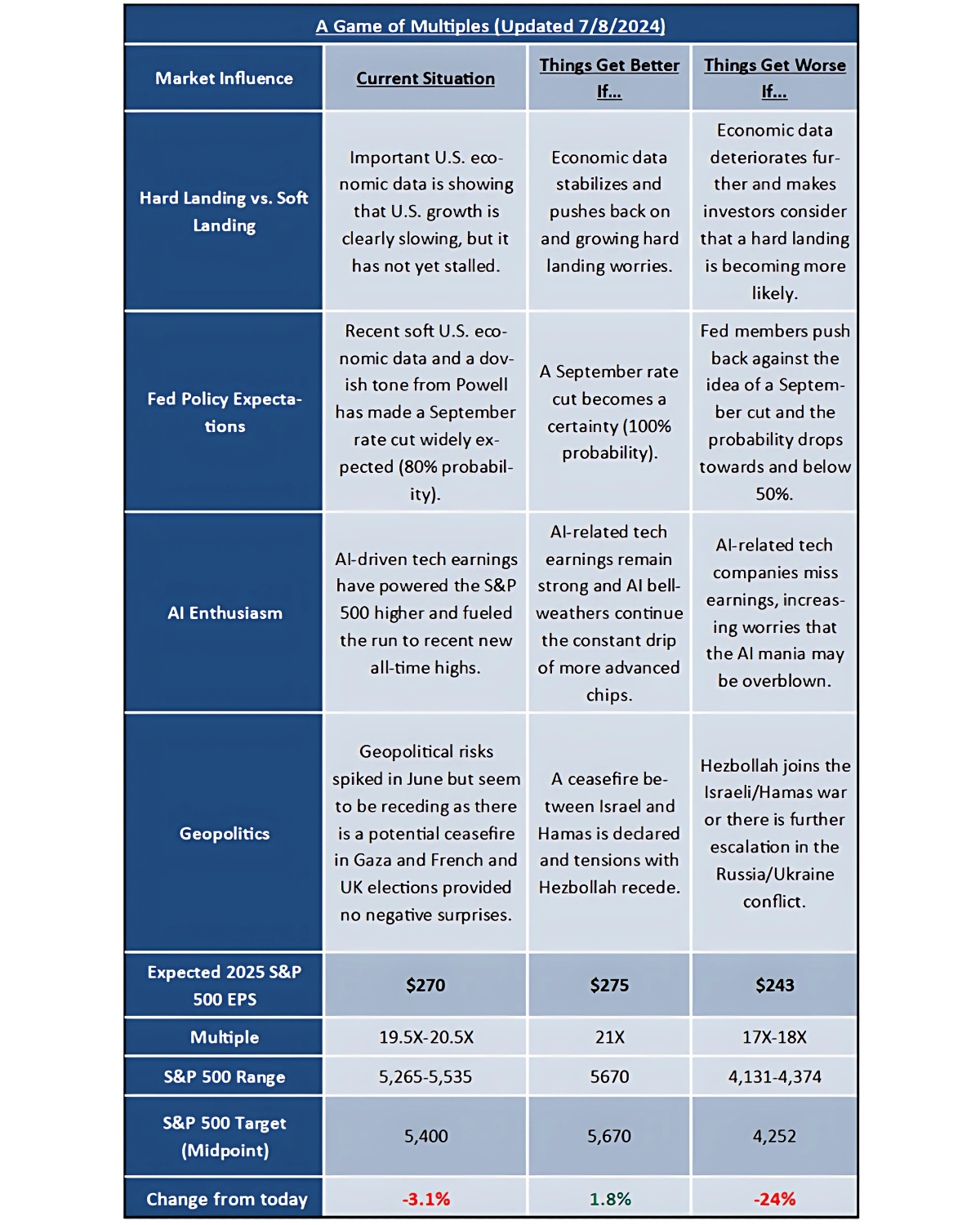

Test #1: Soft Landing

We have seen quite a switch in the outlook for the economy over the past two months. In July, a soft landing was all but guaranteed. However, hard landing fears rose (and stocks dropped) in August and September as the labor market data disappointed. Then, over the past month, data has rebounded and at this point, a “no landing” possibility is openly discussed. Over the next two weeks, we will get important economic updates that will either 1) Validate the soft-landing thesis (positive for stocks) or 2) Challenge it (one way or the other, via a no landing or hard landing). Specific data points to watch include the jobs report, ISM Manufacturing PMI¹, and Services PMI (the first two out this Friday, the Services PMI out next week). For markets to pass this test, economic data needs to remain Goldilocks (so not too hot and imply no landing and less rate cuts, or too soft and hint at a recession).

Test #2: Earnings

Earnings have been, in many ways, the “unsung hero” of this rally as earnings growth has remained remarkably consistent throughout 2024, allowing the S&P 500 the fundamental justification to rally to current levels. But we get the final earnings updates for 2024 this week, including AMD/GOOGL and V on Tuesday, META/MSFT on Wednesday AAPL/AMZN, and INTC on Thursday. For the market to pass this test, we need to see guidance from these companies remain upbeat and above expectations, underscoring that earnings growth is solid.

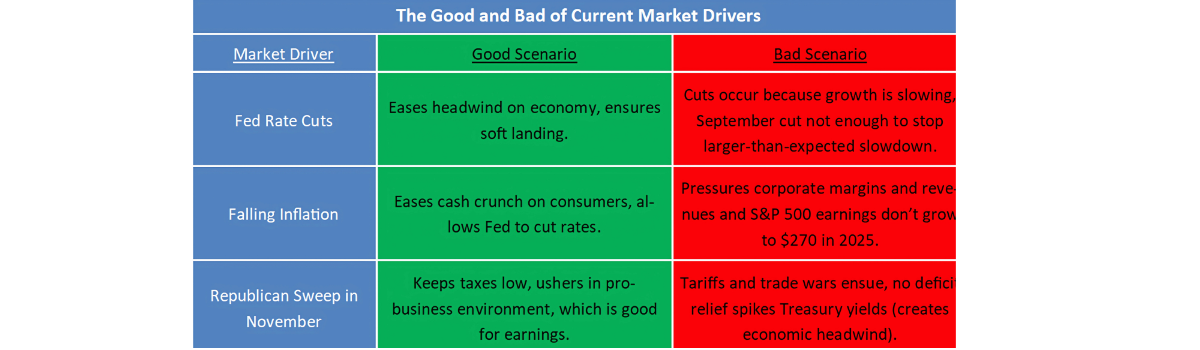

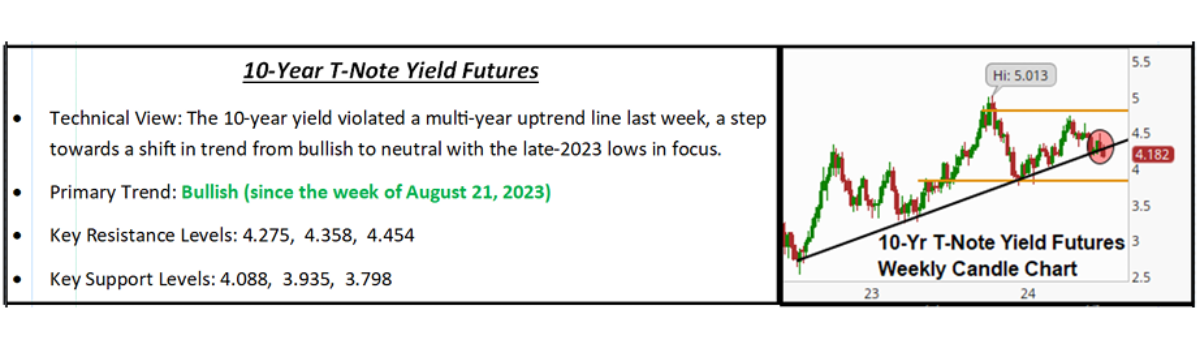

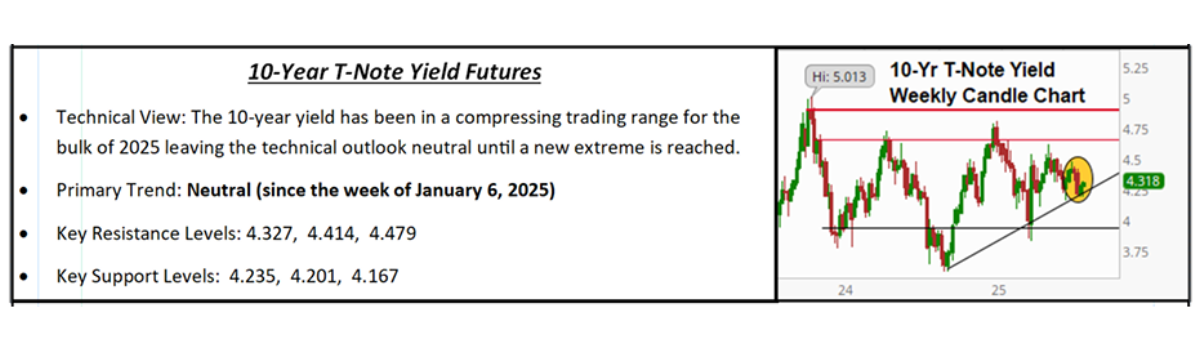

Test #3: Aggressive Fed Rate Cuts

Fed expectations have also shifted wildly in the past few months, as in June just one rate cut was expected, while by August multiple rate cuts were forecast by year-end. The Fed validated those dovish expectations via the 50-bps cut in September and markets proceeded to price in another 75-bps of cuts between then and December. Since then, because of good data and stickier inflation, rate cut expectations have declined to just two 25-bps in November and December and that is less certain than before. For the market to pass this test, Fed rate cut expectations need to stay at two 25-bps cuts in November and December (and not decline below 50-bps of additional easing).

Test #4: Political Calm

Markets have been amazingly resilient in the face of geopolitical upheaval (two ongoing major wars) and throughout this election season, but that will be tested on November 5th! Depending on when the outcome is known (no verdict on, or shortly after election night would be a worst-case for markets) and the make-up of the government post-election, markets may be forced to face (and account for) looming fiscal challenges in the form of budget battles, elevated trade tensions or similar issues. Meanwhile, the transition of power in the U.S. may embolden global adversaries and potentially intensify global conflicts. For the market to pass this test, we need to have political clarity out of the election and have the geopolitical situations (wars) NOT spread or intensify.

Bottom line: The market has been incredibly resilient this year, but that resilience will be tested in a big way over the next two weeks. Vann Equity Management will be here, committed to helping you cut through the noise and stay focused on the core drivers of this market, which remain growth, Fed rate cuts, and earnings. Ultimately, they will determine whether this market extends this rally into year-end; or if we see an uptick in volatility that makes the final two months of 2024 more difficult than the first 10. We have your back!

¹ ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at manufacturing firms nationwide. PMIs use a monthly questionnaire survey of selected companies which provide an advance indication of the performance of the private sector. It achieves this result by tracking changes in variables such as output, new orders, and prices across the manufacturing, construction, retail and service sectors. It is considered to be a key indicator of the state of the U.S. economy.

Economic Data (What You Need to Know in Plain English)

The recent rally in stocks (off of the September lows) has been underwritten mostly by Goldilocks economic data, which largely continued into the end of October. So, while there was some mild profit-taking in stocks, the bigger takeaway has been that an economic soft landing remains the most likely outcome (which is important for the long-term sustainability of this rally).

The key report for October was the flash PMIs and they were Goldilocks! The composite headline beat estimates at 54.3 vs. (E) 54.0, while we saw a familiar weakness in manufacturing (still below 50), but it was not worse than feared at 47.8 vs. (E) 47.6. Finally, the flash Services PMI, which is the most important reading, remained strong at 55.3 vs. (E) 55.0.

Looking at jobless claims, they were mixed as initial claims declined to 227k vs. (E) 243k, and claims have now reversed, again, a temporary spike up towards 260k. Notably, Continuing Claims reached a three-year high, implying those who have been laid off are having a harder time finding new jobs. Now, part of that pop could be because of extended unemployment from the hurricanes or the ongoing Boeing strike. Nonetheless, our team thinks it is fair to say we are seeing cooling in the labor market, just not enough at this point for it to be a negative economic signal.

Bottom line: Economic data has been Goldilocks, and that is a good thing for stocks and bonds because it keeps a soft landing as the most likely economic outcome (and justifies much of the 2024 rally) and because it keeps the Fed on track to continue to ease rates (including two more 25-bps cuts this year).

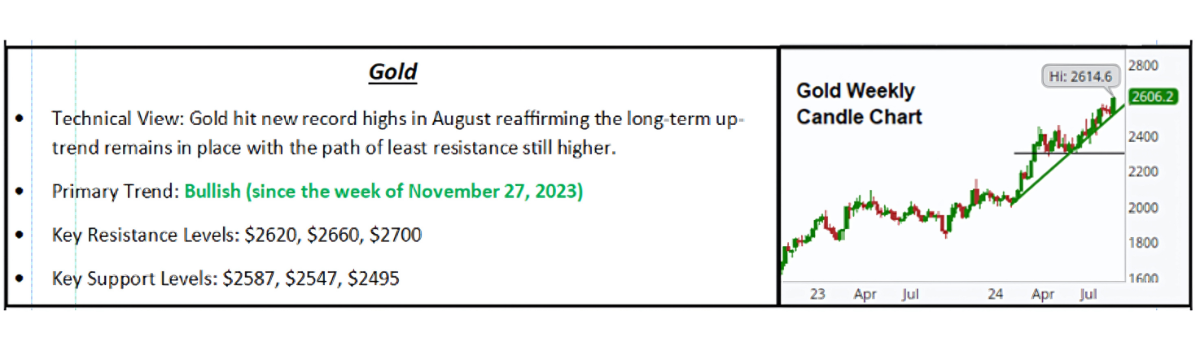

COMMODITIES, CURRENCIES & BONDS

“Commodities traded with a bias to the upside last week thanks to simmering geopolitical tension supporting gains in oil while inflation worries and Goldilocks global economic data kept a bid in both industrial and precious metal varieties.”

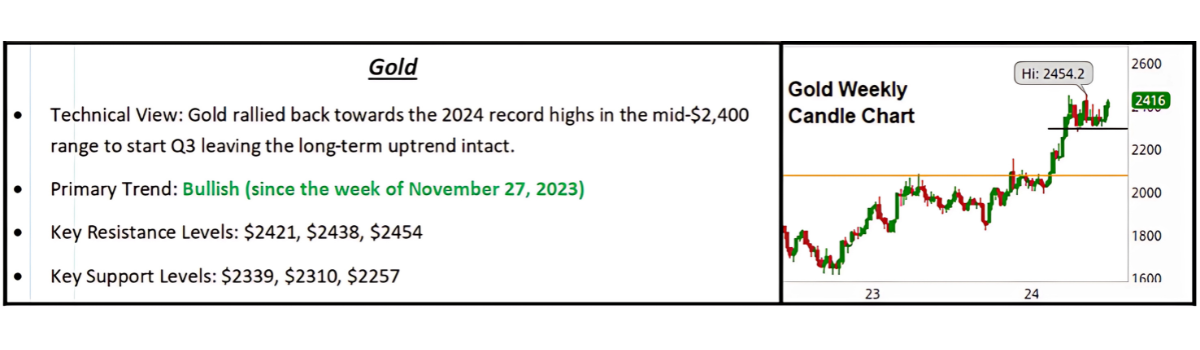

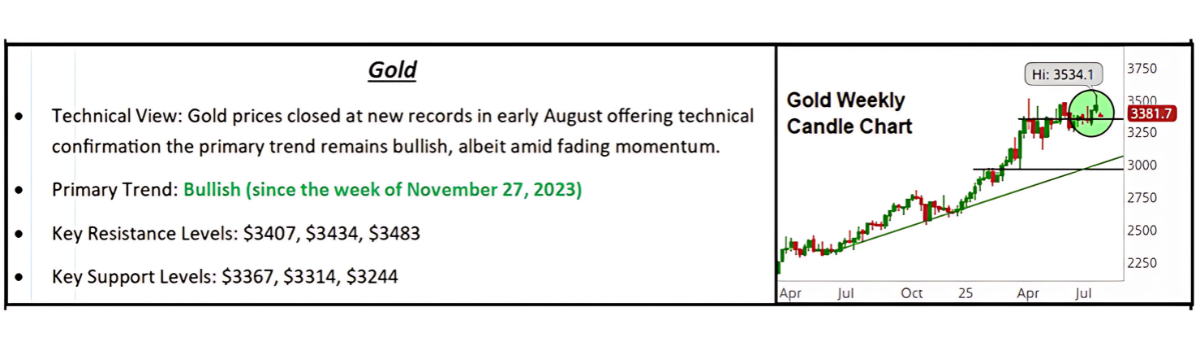

Commodities trade with a bias to the upside as lingering geopolitical tensions kept a fear bid in the oil market while industrial metals were little changed on the economic data, but gold extended the YTD advance to new record highs amid upward-trending inflation expectations.

Looking ahead, there continues to be a fading outlook for demand in oil as an uncertain outlook for the global economy paired with prospects for a rise in global production in the months ahead (thanks to U.S. output hitting new records this month) and OPEC+ members planning production target increases in December, leave the threat of a surplus in the global oil market elevated. Geopolitics remain a critical near-term influence, however, the threat of a price spike in the wake of the weekend’s retaliatory attacks by Israel on Iran is a distinct possibility.

Switching to precious metals, worries about inflation, for now, leave the fundamental backdrop of the gold market bullish, matching the uptrend on weekly charts.

“The Dollar Index extended the gains last week and hit a multi-month high thanks to solid economic data and rising yields.”

Still Not as Wildly Bullish as You Might Think

Sentiment data this month provided a bit of a surprise, because our investment team assumed with the relentless rally in stocks investor sentiment would be pushing the highs of 2024. However, despite a positive view and clear optimism, sentiment is not at the levels that would, by itself, make us concerned the market has become unsustainably stretched. So, while investors are bullish, there is anxiety despite the new highs.

Now, perhaps that level of anxiety is tied to the election, which will be behind us in next month’s sentiment reading; or perhaps it is because investors’ economies are not quite as strong as the S&P 500. Regardless, investors are not as greedy or extremely bullish as the stock market performance would typically imply.

From a market standpoint, there are two takeaways from this analysis. First, sentiment is not widely bullish enough to cause a correction, and that is good. Second, sentiment is still complacent and if one of the positives in this market (stable growth, Fed rate cuts) disappoints, then current levels of elevated bullishness amongst investors and advisors reinforce that we could easily see a 5%-10% air pocket in the S&P 500 (even if the news is not that fundamentally negative).

Bottom line: Sentiment is not a reason to lighten up on stocks, but it does leave this market still vulnerable to a short, sharp pullback, even if the news is not that bad, and we want everyone to be aware of that from an expectations standpoint.

AAII Investor Sentiment

CNN Fear & Greed Index

Investors Intelligence Advisor Sentiment

Disclaimer

The Financial Market Insight is protected by federal and international copyright laws. Vann Equity Management is the publisher of the newsletter and owner of all rights therein and retains property rights to the newsletter. The Financial Market Insight may not be forwarded, copied, downloaded, stored in a retrieval system, or otherwise reproduced or used in any form or by any means without express written permission from Vann Equity Management. The information contained in Financial Market Insight is not necessarily complete and its accuracy is not guaranteed. Neither the information contained in Financial Market Insight, nor any opinion expressed in it, constitutes a solicitation for the purchase of any future or security referred to in the Newsletter. The Newsletter is strictly an informational publication and does not provide individual, customized investment or trading advice. READERS SHOULD VERIFY ALL CLAIMS AND COMPLETE THEIR OWN RESEARCH AND CONSULT A REGISTERED FINANCIAL PROFESSIONAL BEFORE INVESTING IN ANY INVESTMENTS MENTIONED IN THE PUBLICATION. INVESTING IN SECURITIES, OPTIONS AND FUTURES IS SPECULATIVE AND CARRIES A HIGH DEGREE OF RISK, AND SUBSCRIBERS MAY LOSE MONEY TRADING AND INVESTING IN SUCH INVESTMENTS.